I struggled with this question for a long time and did what most beginner traders do which is to over-trade and place trades irrespective of what the markets were doing. This is a major mistake and it’s crucial to have a strategy which tells you when to trade and equally importantly when not to trade and stay out of the markets.

The idea behind this is called the “floating boat” principle. i.e. on a rising tide all boats get higher. It’s the same in the stock market. If the market is on a rise then most stocks will also rise and vice versa. Betting against the general trend is a losing game.

There are also times when it’s better simply to sit out the market and not trade – you want an edge so why trade when you have no edge?

So the question remains – how do you decide when you have an edge and a potentially high probability trade? Here is one of my methods:

You may know that I use Sharepad as a tool for identifying trades (if you quote my name and account number when you subscribe, then I get a couple of months free at zero cost to you! My full name is Colin Hardwick and my account number is 283552)

Sharepad has a great training zone where you can learn how to set up filters, which is what we need to identify “floating boats”. You can see how to set up filters here:

https://www.sharescope.co.uk/sharepad_tutorial5.jsp

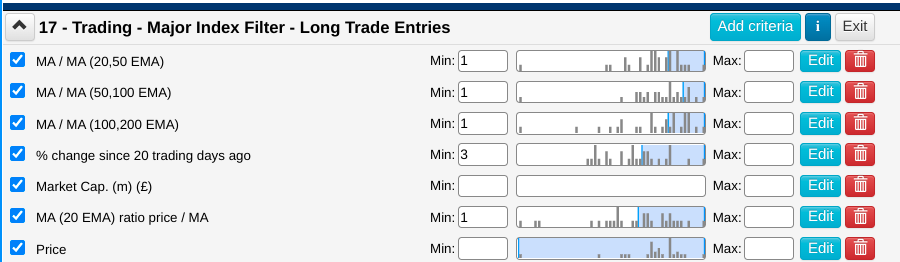

I set up a filter with the following criteria:

What this is doing is comparing exponential moving averages (the 20, 50, 100 and 200 day) with each other and filtering for indices which satisfy my criteria.

As an example the first criterion at the top of the list compares the 20 day EMA with the 50 day EMA and selects those major indices where 20 day is above the 50 day (since I’ve entered a minimum value of 1 in that criterion)

This is repeated for the 50 day compared with the 100 day and the 100 day compared with the 200 day, again with a minimum of 1 selected.

The next criterion is the % change in price since 20 days ago and I’ve entered a minimum of 3%. You can enter any figure here but if you set it too high then the criterion will never be satisfied.

Next I set the ratio of price to 20 day moving average to a minimum of 1 which means it will filter for any major index where the price is greater than the 20 day EMA.

Finally I list the price and the market capitalisation. The price is just because I like to know the latest price and the market cap only applies when I use this filter for individual shares etc (indices don’t show a market cap)

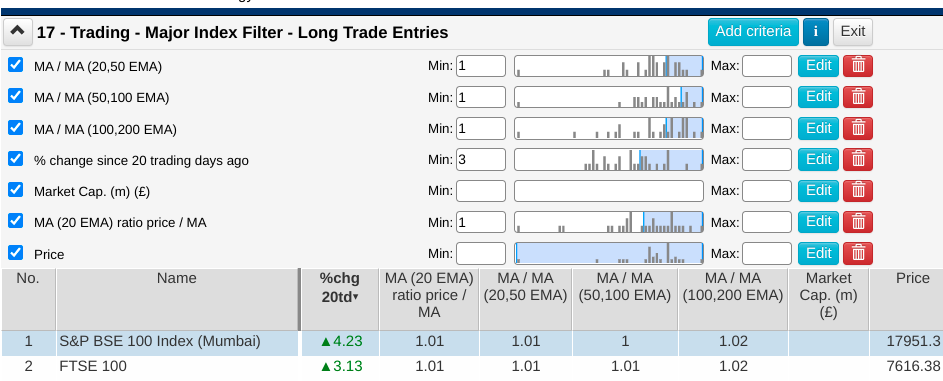

Run this filter by clicking on “Apply” which appears at the top of the list when you have entered each criterion and Sharepad looks at at each major index for any that satisfy EVERY one of the criterion listed.

If I run it today (Friday, April 15th) the return looks like this:

You can see that the only indices that meet all the criteria are the S&P BSE Index (Mumbai) and the more familiar FTSE 100. I don’t trade the Mumbai index but I will trade shares within the FTSE 100.

The results of the filter means that new trades can only be entered on shares contained within the FTSE 100. The filter may have shown no indices qualify, in which case I won’t enter new trades and will simply wait for a more positive trend developing.

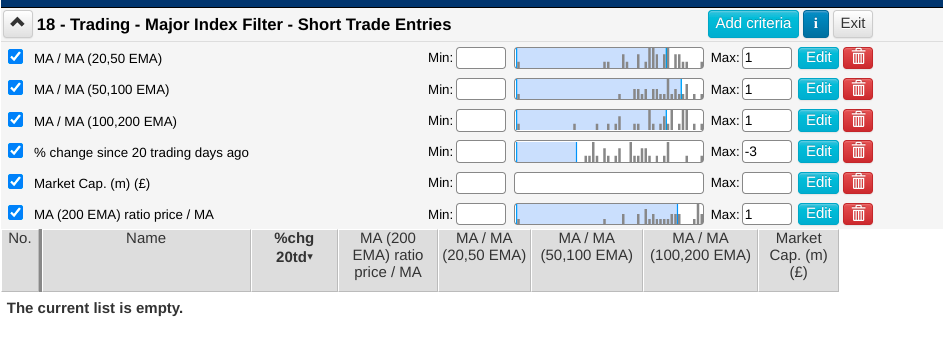

The other option is to set up a similar filter for down-trending indices with criteria set as follows:

You can see the settings are the opposite of the long filter and that when I run the filter there are no indices that satisfy all the criteria, the return says “The current list is empty”.

So we have one index that allows long trades and no indices that allow short trades. This is typical of a non-trending world trading environment and this means trade entries are limited to only shares that are contained in those indices which meet either the above long and short filters.

Remember that this technique is to identify suitable trade entries. I’ll discuss monitoring trades and exiting them in a future post.

Leave a Reply