Trading is one of the most difficult jobs in the world – you only have to examine the proportion of people who lose money (typically 70% to 90%) on trading platforms to know that making any money at all is, for most people, impossible.

The process itself is simple but not easy and for every trade you place, there is someone on the other side taking the opposite trade to you. These people are among some of the smartest, most determined and focused people in the world, so don’t be under any illusion – the chances are that you will lose money and some people lose a LOT of money.

Let’s look at the trading process in more detail.

Step 1: Find a trading method that suits you, your personality and the time you have available to trade. If you are time limited, impatient and like to take some risks then you will select different trading methods to someone who is retired, patient and controlled. Many people are attracted to the so called glamour of day trading but it’s very hard, requires high levels of concentration and huge amounts of time sat in front of a computer screen. Not my cup of tea at all!

My own preferences are for trades on individual equities (although I will trade other instruments such as indices occasionally when an opportunity presents itself) with a holding period of typically 1 – 3 months using fixed stops that I move manually. I’m equally comfortable going either long or short. That’s not a recommendation – do your own thinking and research!

Step 2: Find trading ideas. The best trades are found using a combination of technical analysis with charts and some kind of catalyst that has the potential to make a stock move. An example of a catalyst would be a world event (such as conflicts) or a profit warning from the stock in question.

I keep a close eye on world events and also use the Regulatory News Service (RNS), which is the London Stock Exchange’s news feed. These provide announcements throughout the day from 07:00 until 18:30 and all price-sensitive information is covered such as company results, trading updates and contract wins and directorate changes. You can see it here:

https://www.londonstockexchange.com/news?tab=today-s-news

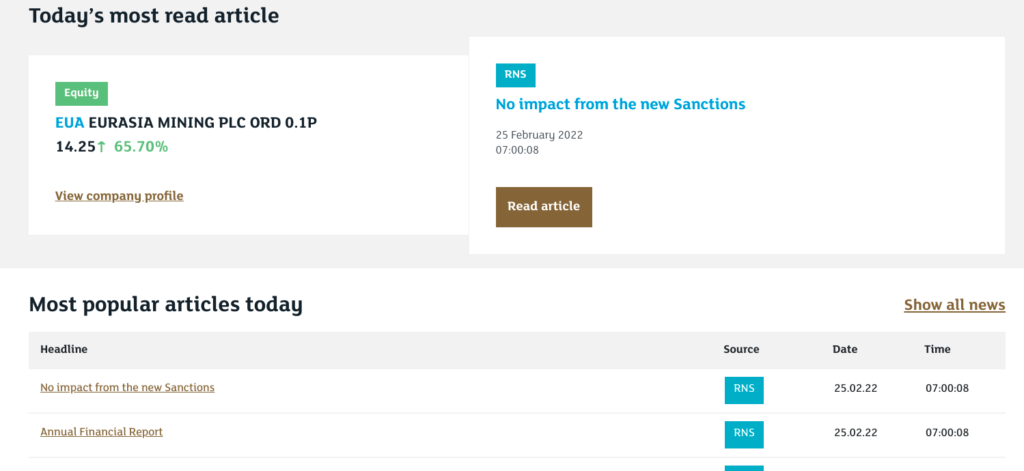

Here’s an example of a recent news alert:

We can see that the article was published on 25th February 2022, at 8 seconds past 07:00 am and it concerns Eurasia Mining PLC.

If you click on “Read Article” you can see the actual details. In this case it was a declaration that the recently announced sanctions from the west on Russia for it’s invasion of Ukraine would have no impact.

More importantly you can see that the stock rose 65.7% in reaction. This may have offered a trading opportunity – again – do your own research! Here’s a useful video on using the RNS:

For technical analysis I use a tool called Sharepad. The best description I’ve seen of the use of Sharepad is by Michael Taylor, who is a “full-time UK trader of his own private capital since December 2016”. You can see how he uses Sharepad here:

Step 3: Enter the Trade. The most important aspect for me is to correctly position size the trade. I prefer to risk between 1% and 2% of my capital bank on each trade and use the average true range (https://www.investopedia.com/terms/a/atr.asp) to set the required stop. As an example:

I find a stock that I want to trade. Let’s call it Acme Ltd and it’s trading at 100 pence.

The ATR (for a period of 20) is 14. I go long (i.e. bet that the stock price will rise) at 100p with a stop set at 1 * ATR. The stop is therefore set at 86. If the stock price drops to 86p then we will be stopped out and the trade closed by our trading platform. If the stock rises significantly then I move the stop up behind it.

If the stock price moves above 114, then I can move the stop to 100 and the trade risk is virtually eliminated. I say virtually because it is possible for the stock to “gap” past our stop limit. You can get around this risk by using guaranteed stops but there is a cost in doing so if the stop is hit.

Step 4: Monitoring the Trade. This is a key aspect for me. I monitor the trade daily and make decisions on moving stops and trade continuation after the markets close each day. There are several potential decisions:

The stock is moving as expected and no action is required.

The stock has turned against me significantly and I decide to close the trade.

The stock looks like it is starting to turn against me. Do I need to reduce the risk by moving the stop closer?

The stock has moved significantly in my favour. Move the stop to take risk out of the trade and protect capital.

I use Sharepad to monitor the trade. I place horizontal lines on the chart for trade entry and trade stop positions as well as a vertical line for the date of entry. You can set Sharepad to place a horizontal line at the current share price. This all gives me a very useful visual image of each trade and how it is progressing. You can see an example below:

I’ll write about this in much more detail in a later post.

Step 4: Exit the Trade. There are two ways out of the trade. Either I decide to exit the trade or the trade stops out.

I prefer to exit the trade myself rather than wait for the stop to be hit but it really depends on how the stock has moved and where the stop actually resides.

If the stock has run up a tidy profit (and I look for at least a 3:1 reward:risk ratio) then I’m more comfortable letting the trade stop out. If the trade is not going well then I’ll exit quickly.

There is a lot of truth in the phrase “cut losers quickly and let winners run“!

Leave a Reply